Tech Stocks Jittery as New Chinese Tariffs Loom

The Dow Jones and S&P 500 had a jittery Thursday as a new tariff deadline nears. The S&P 500 fell 0.3 percent, while the Dow Jones Industrial Average dropped 0.53 percent (138.84 points). That’s a substantial improvement for the Dow, which dipped as much as 450 points during the day.

The isn’t being driven by any single company’s quarterly performance, but by the looming imposition of fresh tariffs on Chinese goods. The Trump Administration has announced that it will raise tariffs on $200B worth of Chinese goods from 10 percent to 25 percent, and impose new 25 percent tariffs on an additional $325B worth of goods.

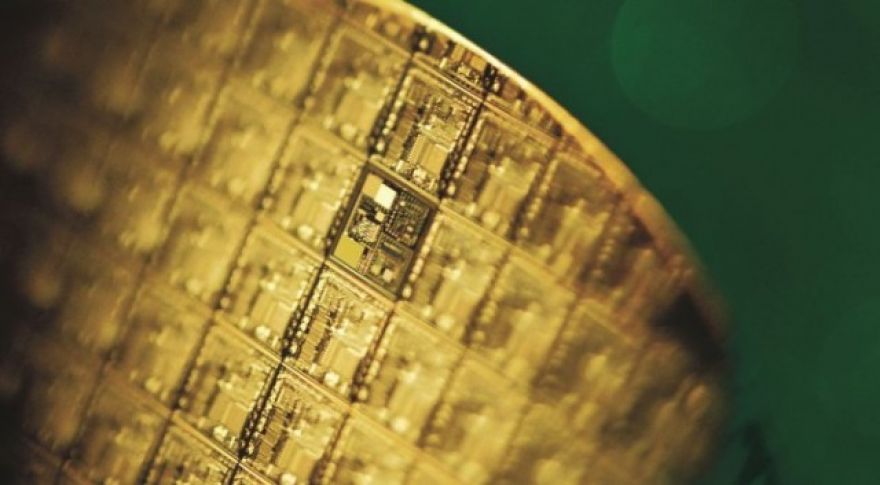

While it’s absolutely true that the US imports far more from China than China does from the US, many of the products China does import are technology-based. According to the South China Morning Post, semiconductors are China’s leading import by value, exceeding even crude oil. While the country is trying to pry itself loose from US dominance, it hasn’t yet succeeded.

But this also means that technology companies are doubly exposed to the problem. Any products they build in China could theoretically be targeted for tariffs, while the Chinese reliance on US technology imports means these same companies could be hit if the Chinese impose retaliatory tariffs in turn. Much depends on the structure of the tariffs — when the first wave went into effect last year, mobile phones were exempted while video cards weren’t. Earlier this week, RBC analyst Mitch Steves noted that companies like Nvidia are directly exposed to this risk.

“A major concern here, the products would be deemed mission-critical and the US would prevent shipments to China, or tax them heavily (a large buyer of GPUs),” said Steves. “We think China trade talks will negatively impact our universe. Most notably, we think GPUs and Semi-cap are most at risk to the downside if tensions continue to rise.”

Chinese semiconductor imports.

Trade negotiators from the US and China began meeting at 5 PM ET in an attempt to strike a deal, but analysts have not been optimistic about the chances of a quick conclusion. Up until last week, the US and China were believed to be making progress towards a trade deal, but the Chinese reportedly substantially altered their own negotiating position and were no longer willing to make certain concessions that had been provisionally hammered out. Top priorities for the United States have been the need for stronger IP protection and the issue of forced technology transfers, in which US companies wishing to do business with China are required to grant access to their own IP and partner with local companies in order to do so.

IP theft has been a major problem in China overall. Chinese memory manufacturers are accused of collaborating with UMC to steal technology from Micron, and Samsung has accused China of stealing its foldable phone technology. It’s not clear if Samsung’s foldable phone research is actually worth any money — the Galaxy Fold disaster implies the company is nowhere near ready to actually launch product — but that doesn’t change the fact that the IP was stolen and sold to Chinese companies in the first place.

It is not clear when these issues will become major drags on the tech economy, but they absolutely will if this trade war continues to escalate. The math simply doesn’t lie. If more goods are hit with tariffs, the price of those goods will inevitably rise beyond what companies can absorb without raising prices. Higher prices can impact demand, depending on the underlying elasticity of the goods in question. And tech companies that sell silicon on both sides of the Pacific could be doubly hit, depending on how all of this shakes out.

Now Read: